How mobile deposit works

Explore these simple steps to deposit checks in minutes.

Nov 13, 2020 There is no limit on the amount you can deposit at a Wells Fargo ATM. Some ATMs have a limit on the number of bills or checks you can deposit in a single transaction, but this is based on the limitations of the ATM itself. You can always do multiple transactions to deposit the amount you want. I deposited a check for $7,000 and Wells Fargo Bank put a hold on it. Initially their representative told me if was due to insufficient funds. I spoke to the payor and their bank and they assured me the funds were sufficient and that Wells Fargo had already obtained the funds from their account.

1. Download the Wells Fargo Mobile app to your smartphone or tablet.

2. Sign on to your account.

3. Select Deposit in the bottom bar. Or, use the Deposit Checks shortcut.

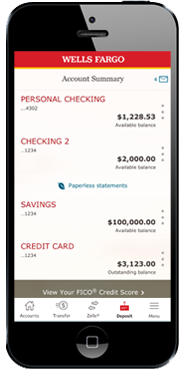

1. Select an account from the Deposit to dropdown. If you have set up a default account, it will already be pre-selected.

2. If you want to create or change your default account, go to the Deposit to dropdown and select the account you want to make your default, then select Make this account my default.

1. Enter the check amount. Your account’s remaining daily and 30-day mobile deposit limit will also display on the screen.

2. Make sure the amount entered matches the amount on your check, and select Continue.

1. Sign the back of your check and write “For Mobile Deposit at Wells Fargo Bank Only” below your signature (or if available, check the box that reads: “Check here if mobile deposit”).

2. Take a photo of the front and back of your endorsed check. You can use the camera button to take the photo. For best results, use these photo tips:

• Place check on a dark-colored, plain surface that’s well lit.

• Position camera directly over the check (not angled).

• Fit all 4 corners inside the guides on your mobile device’s screen.

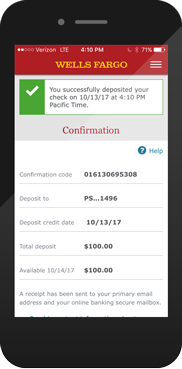

1. Make sure your deposit information is correct, then select Deposit.

2. You’ll get an on-screen confirmation and an email letting you know we’ve received your deposit.

3. After your deposit, write “mobile deposit” and the date on the front of the check. You should keep the check secure for 5 days before tearing it up.

Still have questions?

Quick Help

Call Us

Find a Location

Mobile deposit is only available through the Wells Fargo Mobile® app. Deposit limits and other restrictions apply. Some accounts are not eligible for mobile deposit. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. See Wells Fargo’s Online Access Agreement for other terms, conditions, and limitations.

LRC-0620

Wells Fargo Check Deposit Options

If a deposit has already posted to your account, you can order a copy of a past deposit slip online or select View Details beside the deposit if you are already signed on.

If the deposit has not yet posted, or if the deposit was made to an account you do not access online, call us at 1-800-TO-WELLS (1-800-869-3557). Please have your Transaction Receipt available when calling.

Wells Fargo Check Deposit Policy

More information about deposit slip photocopies:

- You may obtain a photocopy of a deposit slip within seven years of the deposit date.

- Please allow up to ten business days for delivery.

- You may also request copies of the checks that were included in the deposit.

- A Document Copy Fee may apply when Wells Fargo provides you with a paper copy of a deposit slip and/or the accompanying checks. For additional information, please refer to your Consumer Account Fee and Information Schedule, or call us at 1-800-TO-WELLS (1-800-869-3557).

To order new blank deposit slips, call 1-800-TO-WELLS (1-800-869-3557) or sign on to access Order Checks and Deposit Tickets on Wells Fargo Online.